Correct Sales Tax in Sage 100 by Creating an AR Credit Memo

Have you ever incorrectly charged sales tax on an invoice where the customer was exempt? You know you need to create a credit memo for sales tax only, but you aren’t sure exactly how to do it?

There are a few different ways this can be accomplished. The most straight-forward way to accomplish this is to create an Accounts Receivable Credit Memo.

- Go to Accounts Receivable > Main > Invoice Data Entry.

- Type in CM and hit Enter at the Invoice Number Field (this alerts Sage 100 to the fact that you’re entering a Credit Memo.

- Select the Customer.

- If you want this to be applied directly to a customer’s invoice, enter that invoice number in the highlighted field.

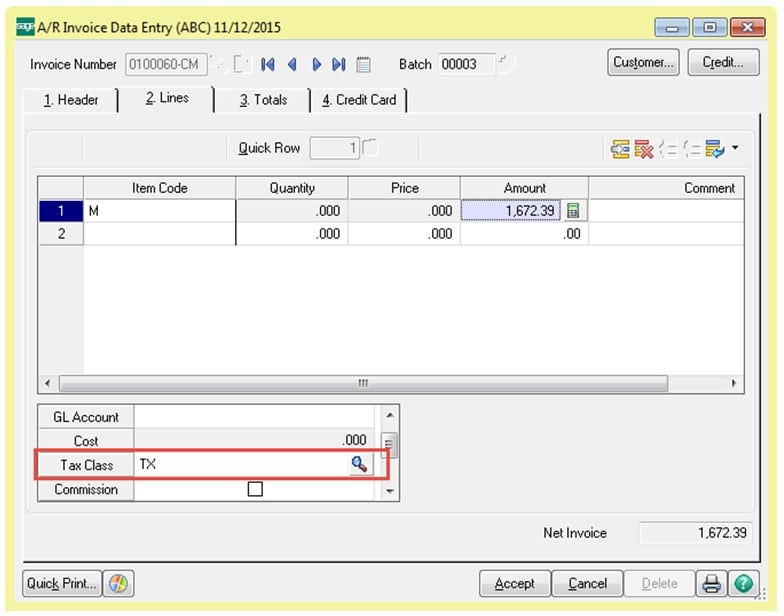

- On the Lines tab, use Miscellaneous item code “M” (or “/M” if you create a credit memo through Sales Order > Invoice Entry).

- Enter the TAXABLE SALES dollar amount from the affected invoice(s).

- Make sure you change the Tax Class to TX (as shown above) and specify a GL account – you will use this in a moment.

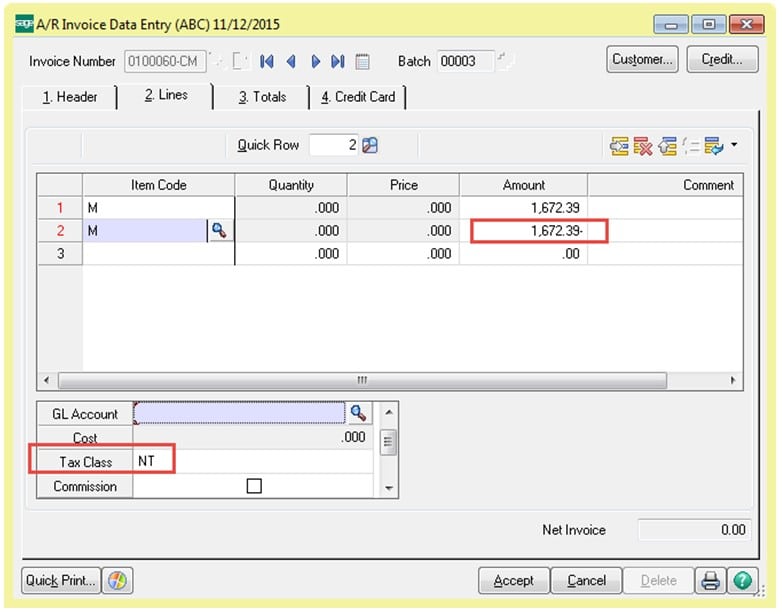

- On the next line, enter the same code, “M” or “/M” in Sales Order.

- Enter the Taxable Sales amount as a NEGATIVE dollar amount and use the exact same GL account as used above.

- The Net Invoice will appear to be Zero because the sales dollars are exactly offsetting each other.

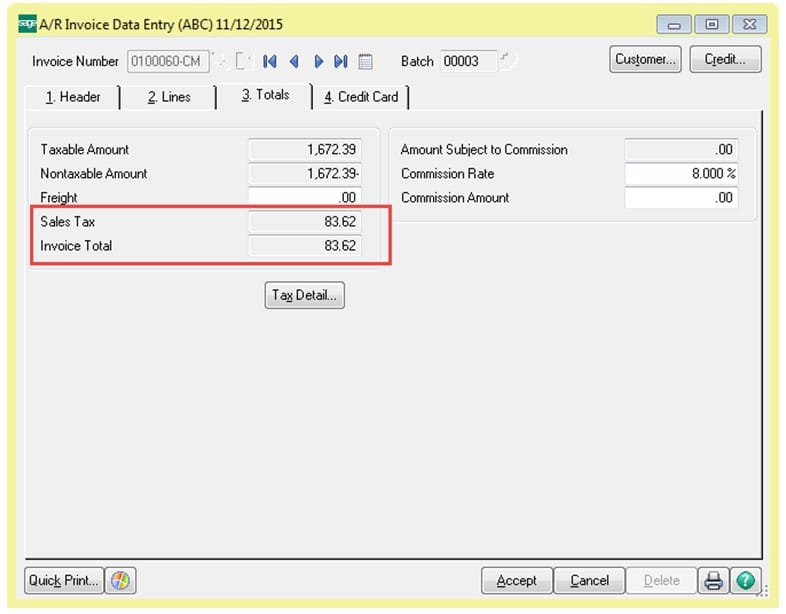

- The totals tab will show the change through sales tax dollars.

- Accept and post the credit.

This transaction will correct your Taxable and Non-Taxable sales dollars as well as Sales Tax liability in your Sales reports.

If you have questions or would like assistance correcting sales tax in Sage 100, please contact our Sage 100 support team at 260.423.2414.

Register for our Sage 100 newsletter today!