Tracking the Employer portion of 401(k) contributions

Many employers offer various forms of matching an employee’s contribution for the employee’s retirement. As an employer, wouldn’t it be nice to automatically figure that contribution and get the liability and expense recorded without having to manually calculate? And, a bonus for the employee is that it is possible to show each employee how much the company is contributing on his or her behalf.

Employers often offer graduated matching for an employee’s contribution to some form of 401(k) deferred compensation plan. Here is some direction in getting the matching portion configured.

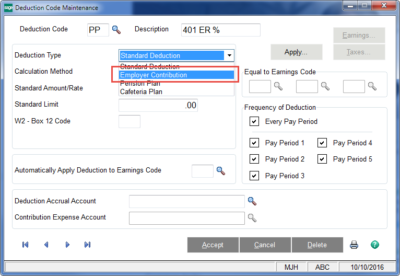

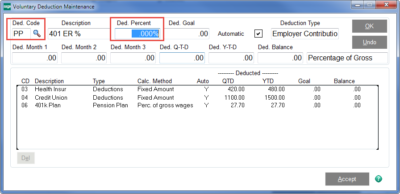

Under Payroll > Setup > Deduction Code Maintenance, create a new code to reflect the Employer Matching contribution.

Of the four deduction types, the Employer Contribution will NOT affect an employee’s net pay, but rather allow for the calculation of a separate liability/expense which is associated directly with that employee.

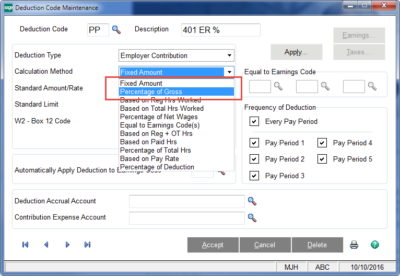

Determine how you want this contribution calculated. Typical methods are based on percentages or possibly fixed amounts.

In this example, we are going to select Percentage of Gross. We are going to leave the Standard Amount/Rate at ZERO, as this will be specified on an employee-by-employee basis to reflect the match for that individual employee.

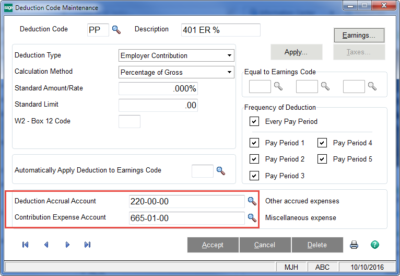

Assign the appropriate Liability and Expense accounts in which you want to track the Contribution.

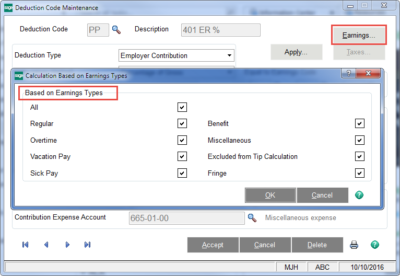

If you need this to be applicable only to certain types of earnings, click on the Earnings button and then checkmark the appropriate earnings types on which the contribution will calculate.

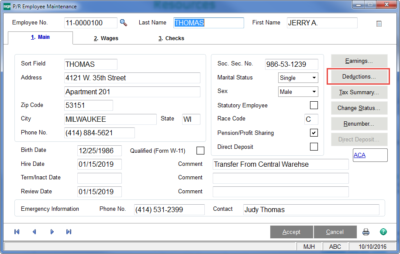

Apply the Deduction Code to eligible employees.

Click OK and then Accept. On the next payroll, the Employer Contribution will start automatically calculating.

For more information or assistance on how to set up an employer contribution in Sage 100, please contact our Sage 100 support team at 800.232.8913.

Register for our Sage 100 newsletter today!