How does the “Cash” option work in various Accounts Receivable (AR) transactions? There are times when we want to record physical cash that has been received in lieu of other forms of payment. How do we handle these types of transactions and what are the effects on Bank Reconciliation?

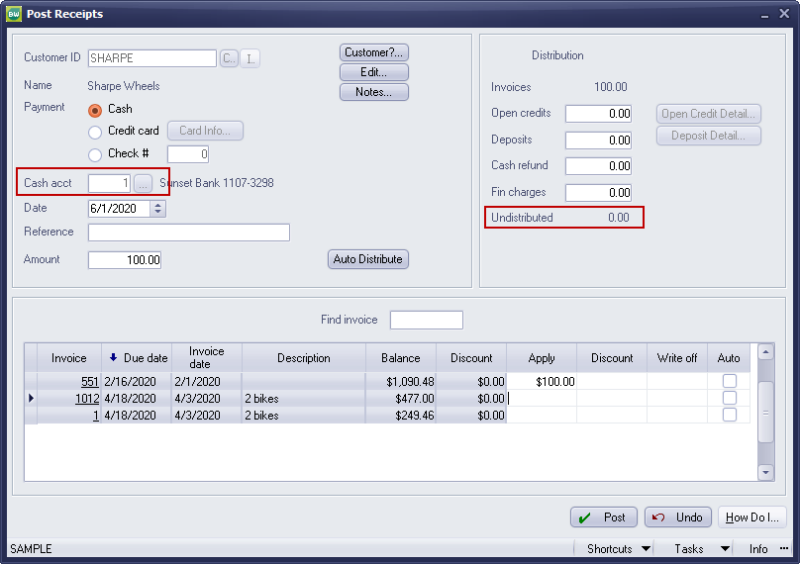

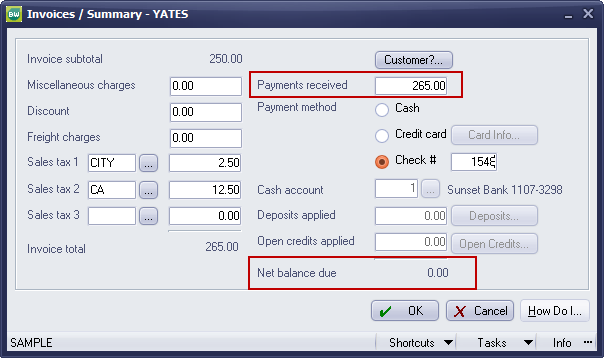

When an invoice payment is being received, select the Cash Account into which you want the funds to go. The account defaults to the bank account specified in AR > Utilities > Maintain A/R Parameters – Posting Accounts.

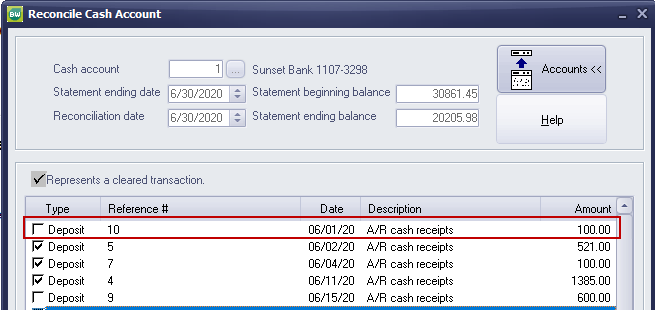

Make sure that all funds are properly distributed. This receipt will then be available to become part of a Bank Deposit. Include this with other receipts as necessary to affect Bank Reconciliation

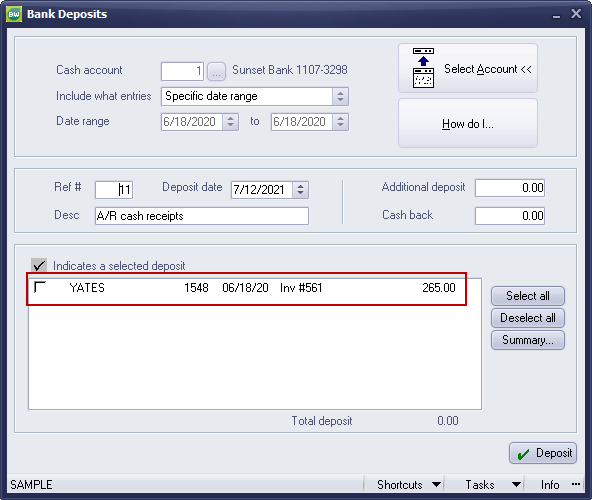

The use of Post Receipts will allow for the transactions to be visible for Bank Deposit.

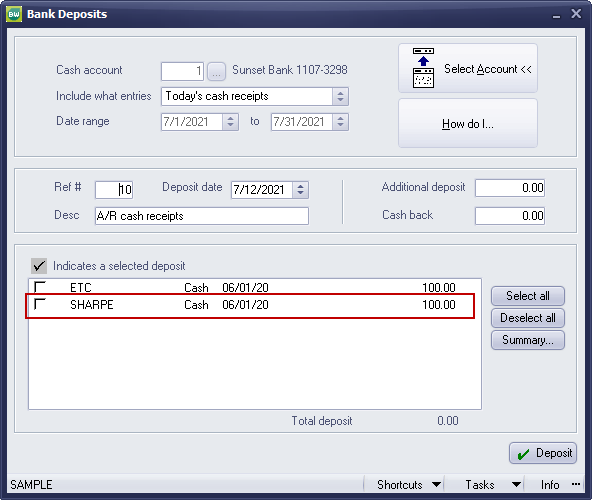

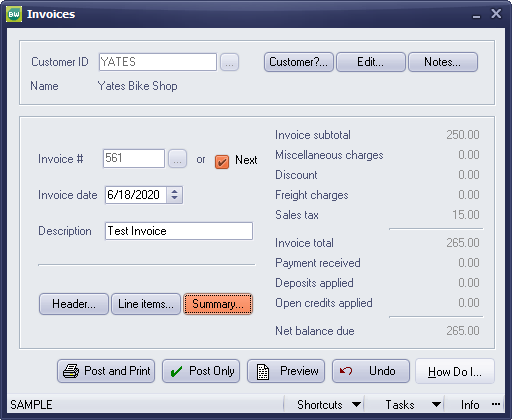

What then happens when we apply cash (or a payment) at the time of invoicing? In reality, the same thing. The payment gets applied immediately to the invoice, so you don’t have to process a receipt. However you still need to create the Bank Deposit to show the funds going into your bank.

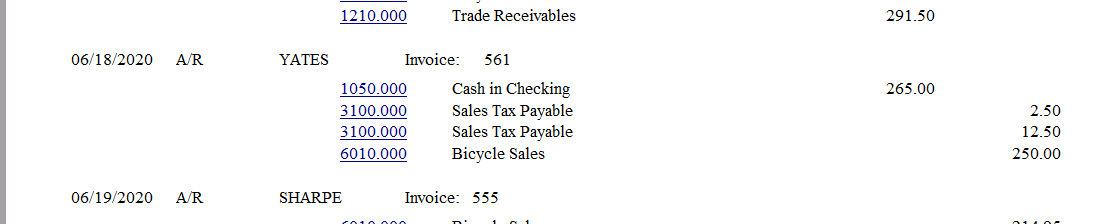

The General Journal Report shows the following:

Bank Deposits shows this:

With regards to AR transactions, it doesn’t matter whether you are receiving cash (or any other form of payment), you still apply the payment to the invoice and record the Bank Deposit.

What happens when I need to issue a refund? The customer is returning product or has an open credit for which we need to return their funds.

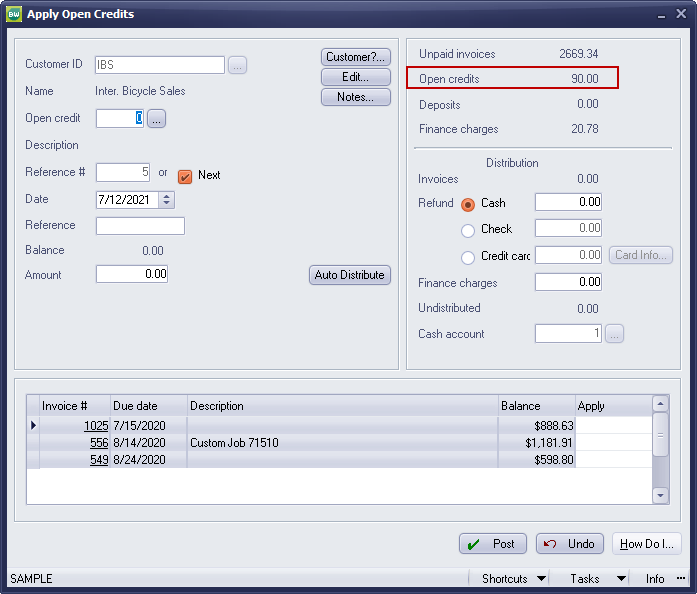

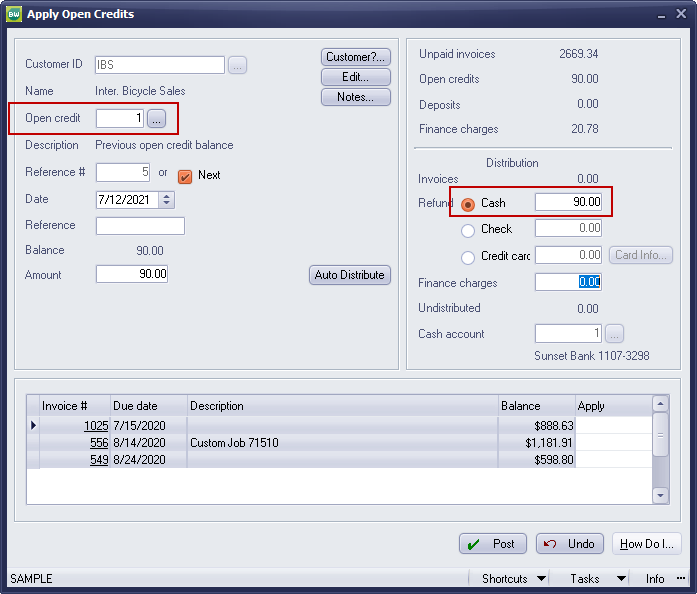

Let’s look at refunding an Open Credit.

Head for AR > Transactions > Apply Open Credits. The refund can be issued via Cash, Check, or even Credit Card, if the original transaction payment was received by credit card.

Look up the Open Credit and apply the refund amount

If Check is selected, you’ll be prompted to create an Instant Check. If Credit Card is selected, and you’re connected to Paya, you’ll be prompted to provide CC information to which the refund will be processed. If you’re not connected to Paya or you select Cash as the refund method, you will see cash leave the GL, but you will NOT see the transaction in Bank Reconciliation. Therefore, you will need to create a Bank Transaction in order to make sure you can properly reconcile.

BusinessWorks does allow for Cash to be an option in various AR-related transactions, but being aware of the effects of your choices will lead to proper results in both the General Ledger and in Bank Reconciliation.

If you have questions or need assistance with your Sage BusinessWorks software, please contact our BusinessWorks support team at 260.423.2414.

Register for our Sage BusinessWorks newsletter today!

Copyright 2021 DWD Technology Group | All rights reserved. This article content may not be reproduced (in whole or in part), displayed, modified or distributed without express permission from the copyright holder.