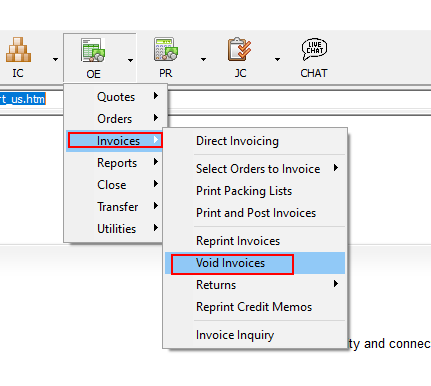

The Void Invoice function is probably the simplest mechanism by which an invoice can be removed from Sage BusinessWorks. However, it comes with some constraints. To access this function:

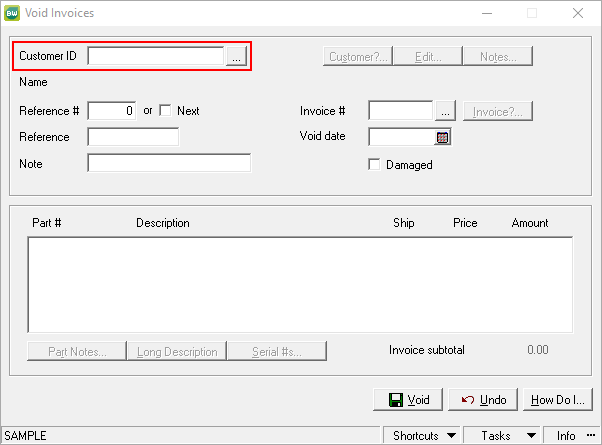

Since this function is effectively creating a Credit Memo, the prompt to Load Forms may be encountered (depending on system settings.) Click OK to proceed.

Select the Customer ID for whom the credit is being created.

Then select the Invoice Number to reverse. An invoice may be VOIDED only if nothing has impacted the invoice after its creation. If the invoice has already been changed in some way (Edited or payment applied or debit/credit memo applied,) the ability to VOID the invoice will not be allowed.

Specify a Void Date and whether or not the item(s) should be marked as “Damaged”. Marking this box will allow for a credit to be created, but it will not return the material to inventory.

Click Void to record the transaction. As this transaction returns EVERY item at its original shipped quantity, partial credits may be transacted by using the Returns function.

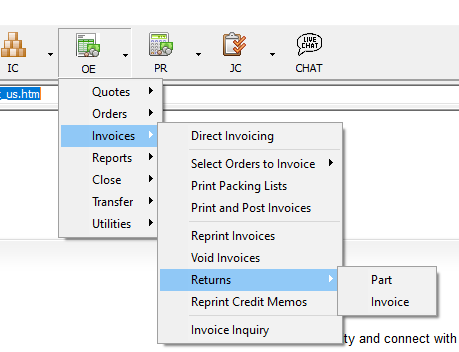

Selecting Part under the Returns menu will allow for any or all parts to be credited, regardless of whether prior actions were taken against the invoice. It is also possible to create an open credit, rather than specifying an invoice to which this return is applied.

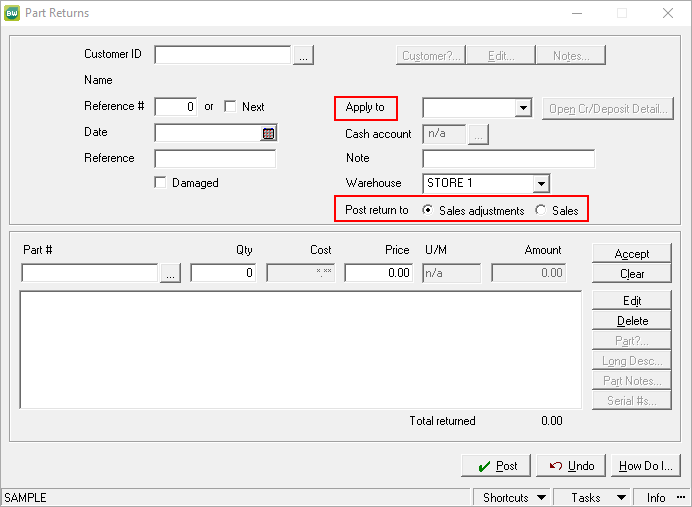

Select the customer, specify the date of the credit, choose how to apply the credit (or issue a refund) and indicate whether the credit should affect the Sales Adjustments or the Sales account (defined by product line or in AR Posting Accounts.) Clicking the “Damaged” checkbox will also determine whether or not the product will be returned to inventory.

*Note: there is no Invoice Number selection on this screen, and this credit cannot be applied to a specific invoice.

Mark the quantity returned for each line item. Click POST when complete.

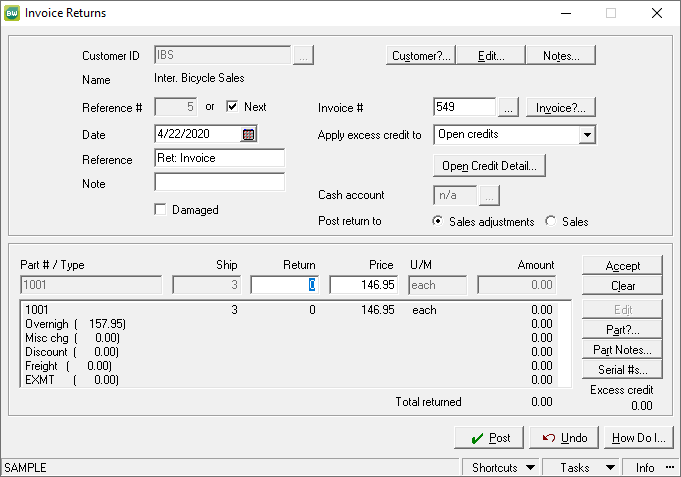

Finally, if a credit/return needs to reference a specific invoice, use OE > Invoices > Returns > Invoice. This option will allow you to apply a credit to a single invoice.

Select how to handle credit applied if in excess of the current invoice balance. Indicate the quantity of each item to be credited, and mark the “Damaged” checkbox if that material is not to be returned to inventory.

As with the other two options, when POST is clicked, a prompt will appear to offer to print the document which can then be filed or sent to the customer for its confirmation of the credit.

If you have questions or need assistance with your Sage BusinessWorks software, please contact our BusinessWorks support team at 260.423.2414.

Register for our Sage BusinessWorks newsletter today!