Simplify Sales and use tax calculations for Sage 100

With sales tax nexus rules and other tax-related regulations changing all the time, it has never been more difficult and track and calculate rates and file accurate sales tax returns.

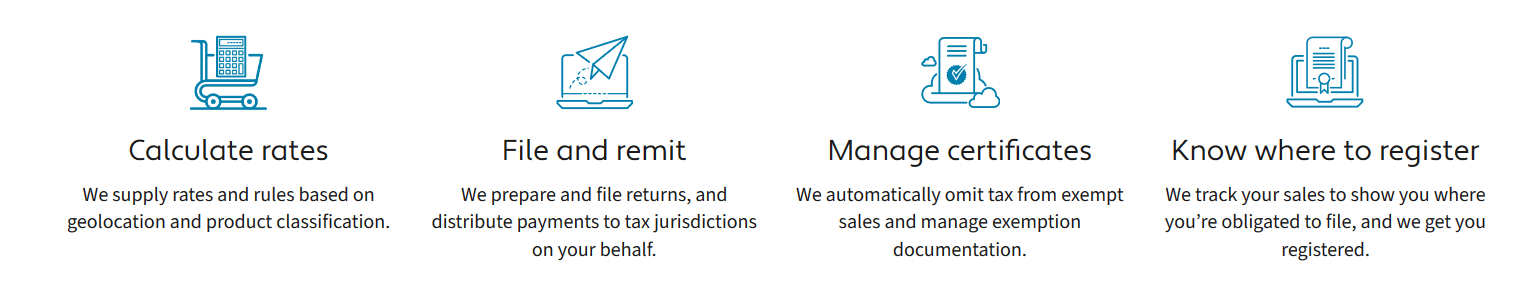

Introducing Avalara AvaTax – technology that automatically calculates sales and use tax for transactions, invoices, and other activity powered by Sage 100. It also simplifies all major steps in the process including calculations based on ever-changing rules and rates, tax filing and remittance, managing exemption certificates, and help you determine which jurisdictions you’re obligated to file in.

AvaTax Key Capabilities

GETTING STARTED IS EASY

Establish a direct link between AvaTax and Sage 100 with a pre-built connection that allows for seamless interaction. In most cases, you won’t need IT support to get started.

RELIABLE TAX CALCULATIONS

Sage 100 sends transaction data to AvaTax, and AvaTax sends back the tax total. Customers, salespeople, and others can see the tax owed in real time — in your shopping cart, for example.

WORRY-FREE RATE UPDATES

AvaTax is updated at regular intervals to reflect changing rates and rules in the 12,000+ U.S. sales and use tax jurisdictions. That means you can stop looking up sales tax rates manually … or at all.

SIMPLE FILING

AvaTax takes you from sales tax calculation to filing in one fell swoop. Just pull your transaction data from AvaTax to prepare your returns each filing period. Or let Avalara handle your returns and filing as part of their Returns service.

DETAILED REPORTING

24/7 access to your AvaTax transaction history comes in handy for many reasons, especially during an audit. The dashboard is simple to navigate.