Since its initial release in 1983, Intuit’s QuickBooks has helped many small and mid-size businesses manage their finances. Known for its ease of use, the popular software has provided the basic functionality that many start-ups needed to launch their business. However, as they grow, many companies realize that QuickBooks no longer meets their needs.

Because of its widespread use, for this particular article we will be comparing the features and functionality of the QuickBooks Desktop Enterprise version vs Sage Intacct.

DWD has been a Sage Software Certified Partner since 2001 and has many years of expertise with both Intuit QuickBooks and Sage 100.

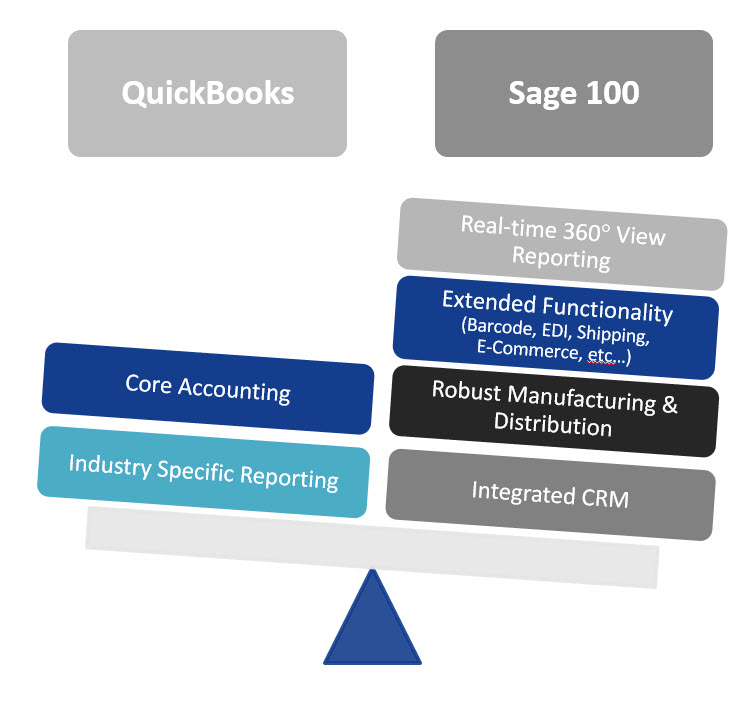

What is The Difference Between QuickBooks and Sage 100

Why do companies using Intuit QuickBooks switch to Sage 100?

- Your business has outgrown the solution (performance-related issues)

- Need for better reporting (financial, operational, compliance and outcomes)

- Need greater visibility over all business activities including desire for financial intelligence, dashboards, and key metrics.

- Manual processes are increasing overhead costs.

- Your shop floor is bogged down with error prone, time-consuming manual processes.

- You’re not able to track labor costs or analyze production costs accurately.

- You’re not able to predict buying and inventory cycles.

- Orders are delayed because you don’t know exactly what’s in your warehouse.

- Looking for a way to provide easy access for remote users to connect to your system.

QuickBooks Desktop vs Sage 100 Side by Side Comparison

| QuickBooks Desktop | SAGE 100/MAS 90 | |

|---|---|---|

| Overall Strengths | User-friendly. Industry-specific reporting. Combine reports from multiple company files. Download bank and credit card transactions into QuickBooks. Track Fixed Assets. User- or role-based permissions. Foreign Currency. TrueCommerce EDI integration. | Integrations, customizable, strong manufacturing & distribution features, maintains performance up to dozens of users, integration between CRM, e-commerce and financials. Data file sizes less restricted. |

| Overall Weaknesses | Once converted to Enterprise, cannot convert back to Desktop version. High volumes of data can slow down the system and/or lead to data corruption. Light audit controls/SOX compliance. Minimal ability to customize data entry screens or add customized functionality. Limited ability to customize forms and reports. | Must use correcting transactions to fix errors, batch processing may lead to improper date postings. |

| Number of Users | Up to 30 | 100s |

| Performance & Scalability | Supports larger file sizes. QuickBooks Marketplace provides for add-on features. | Supports larger file sizes, companies and user counts, supports SQL database, ability to modify software and workflow with scripting and screen customizations, many integrations available to enhance functionality. |

| Financial Management & Reporting | Minimally customizable reports. | Business Insights Dashboard, Reporter, and Explorer, integrates with Microsoft Power BI, create custom reports with Sage Intelligence Reporting and Crystal Reports. |

| Ability to Customize | Limited customization ability. | Extensive codeless customization, change and add screens, unlimited UDFs, ability to fully customize with programming if desired. |

| Best Fit Industries | Financial, Manufacturing, Distribution, Construction, Nonprofit | Financials, Extensive Manufacturing, Multi-site Distribution |

| Best Fit Company Size | Small to Medium | Small to Large |

| Deployment Options | On-Premise, Hosted | On-Premise, Hosted Server, Private Cloud |

| Ease of Implementation | Fairly easy to implement. | Smaller software solutions tend to be easier to implement because there is much less flexibility to tailor the system to specific needs. |

| Avg Implementation Timeframe | 1 to 3 months | Core Accounting: General Ledger, Accounts Receivable, Accounts Payable (2-4 weeks) Payroll: (2-4 weeks) Distribution: Inventory, Sales Order, Purchase Order (2-4 weeks) Manufacturing: Bills of Material, Work Order Processing (4-8 weeks) |

| Avg Implementation Cost | $8,000 – $12,000 | $5,000 – $30,000 |

| Pricing Model | Subscription – single user without payroll starts around $1,800 per year. | Subscription; concurrent user licenses |

| Annual Maintenance Cost | Subscription pricing includes | $600 – $30,000 |

QuickBooks vs Sage 100 Comparison FAQs

Next Step: Evaluate the Pros and Cons

Our familiarity with both QuickBooks and Sage 100 means that we can help you compare the pros and cons of both products for your specific operational needs and business goals. If it’s not the right move, we’ll tell you. If it is the right move, we’ll be there to help you usher in all the benefits of cloud technology.

Take advantage of our free Software Needs Assessment to help you find the best software for your unique needs, whether it be QuickBooks or Sage 100. Our experts are here to answer your questions and provide objective advice so you can find the right solution.