MIP Users – Have you heard about the 2020 1099 changes related to coding non-employee compensation?

Previously, all non-employee compensation was coded to a MISC type and MISC-07 box number. All amounts coded to MISC-07 beginning 1/1/2020 must be updated to the new NEC type and NEC-01 box number.

These changes come with a few challenges as you may be thinking of all the transactions that have already been coded to MISC-07 in 2020.

The FAQs below will help you understand the changes being made to MIP.

Starting January 1, 2020 information that was previously coded to MISC 1099 Box 7 is now supposed to be coded to a 1099-NEC form. How is this done in MIP?

The government changed the rules regarding non-employee compensation starting 1/1/2020. Previously these amounts were code to the 1099-MISC form in Box 7. Now

they will be coded to a box on the new 1099-NEC form.

Prior to version 2020.2 it was not possible to code anything to the 1099-NEC form. It was advised to continue to code items to the MISC-07 box as in the past.

After upgrading to 2020.2 it will be possible to code items to the 1099-NEC form. While it is possible to code items to NEC-01 in 2020.2 there is no provision for automatically migrating information from MISC-07 to NEC-01. With the upgrade to 2020.3 (November 2020) some data will automatically migrate.

To use the 1099 NEC-01 and get the information transferred over several things need to be done.

- Changing vendor defaults to the new box

- Making sure to use the new box in transaction entry

- Moving historical information from MISC-07 to the NEC via 1099 adjustments

Changing Vendor Defaults to the New Box

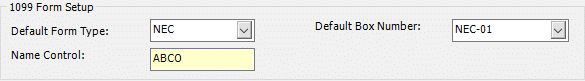

The 2020.2 MIP upgrade process makes it possible to change the default box to NEC-01 but does not automatically change these default values. It is up to the customer to update their vendor information. With the 2020.3 Upgrade (November 2020) the upgrade process will make this change.

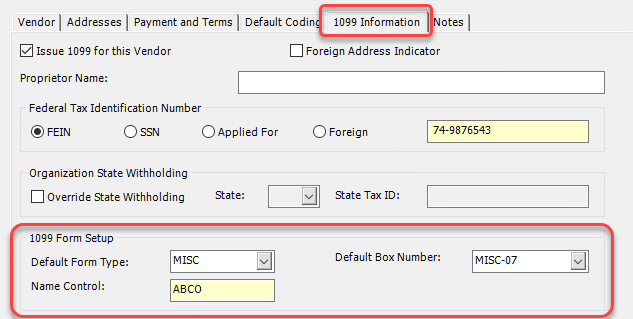

To ensure 1099 transactions are coded properly, it is best practice to update the Vendor default values seen below. All Vendors that have MISC-07 as the Default Box Number will need it to be updated to NEC-01 and the Default Form Type updated to NEC.

If you have a lot of vendors, version 2020.3 (released November 2020) will automatically update the default value from MISC-07 to NEC-01 for any active vendors during the upgrade process.

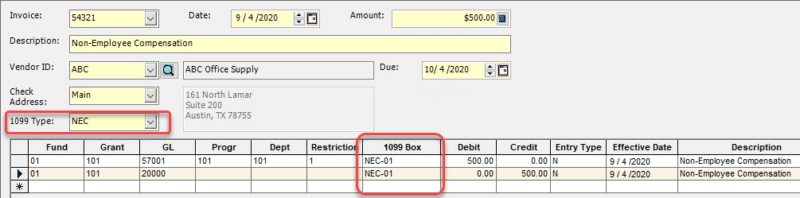

Using the New Information

Users must populate the 1099 Box column in the transaction detail with NEC-01 for any transactions that would have been previously coded to MISC-07. If vendor defaults have been set up, then these values will automatically populate.

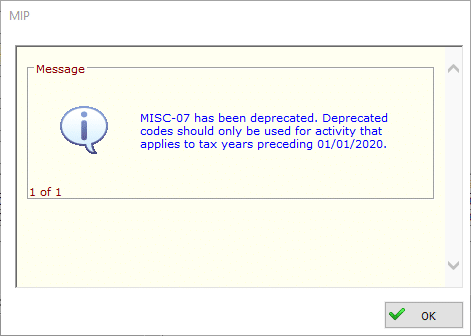

If MISC-07 is used after upgrading to version 2020.2, you will receive the message below. This will not prevent you from saving but it will need to be corrected before processing 1099’s.

Adjusting Historical Information

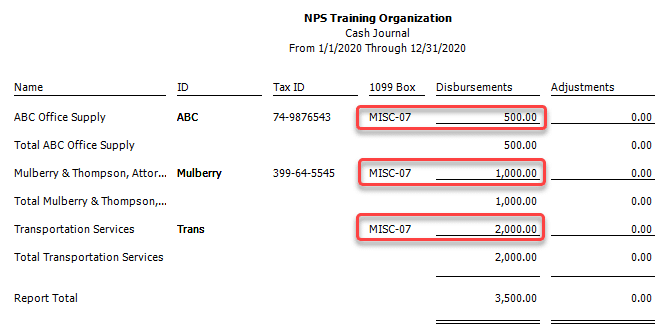

First, you must determine what values need to be adjusted. The changes only affect transactions that have been processed in 2020 and were originally coded to MISC-07. Running a Cash Journal will provide all cash transactions processed within a specific timeframe; in this case, we want to see all of 2020. You can also add a filter to only show amounts coded to MISC-07.

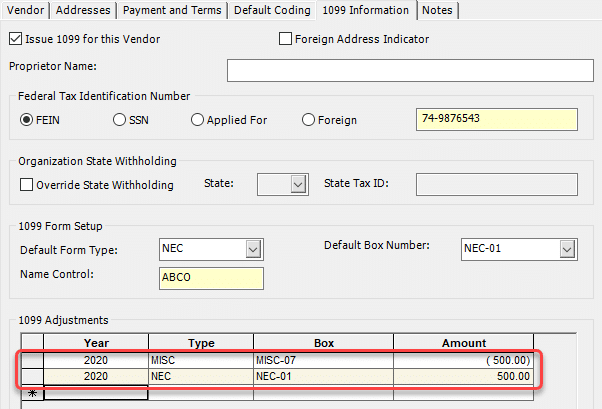

Next, an adjustment will need to be made on each vendor record to ensure that these amounts are updated to the NEC-01 code. A negative adjustment will be made to MISC-07 and a positive adjustment to NEC-01.

Register for our MIP Fund Accounting newsletter today!

If you have questions or need assistance, please contact our MIP support team at 800.232.8913 or info@dwdtechgroup.com.