Better meet your business goals with a cloud solution.

As part of their digital transitions, small and medium-sized businesses across industries are upgrading their accounting and finance operations to robust cloud-based solutions. These agile platforms enable accounting and finance teams to better meet their business goals.

Global marketing intelligence firm IDC interviewed nine U.S. businesses representing a range of industries to gain insights about their decision to retire their legacy on-premises financial and accounting platforms and switch to Sage Intacct, a modern, modular cloud-based solution.

What Are Cloud-Based Solutions?

Cloud-based accounting and financial solutions are replacing cumbersome legacy, on-premise platforms, which are typically overly customized and lack intuitive user interfaces. Cloud-based technologies provide access to software applications and data over the internet.

A cloud-based finance and accounting solution enables employees to access the solution’s platform at any time from any location with an internet connection. It streamlines workflows and automates manual processes, saving employees time and enabling them to spend focus on tasks that improve efficiency and boost the bottom line. Even better, a cloud-based solution provides real-time data and intelligence that helps drive informed decision-making.

Sage Intacct is a robust cloud-based accounting and financial management platform, built by finance experts for accounting and finance teams. It’s the perfect solution for a wide range of industries, including software, nonprofits, professional services, healthcare, hospitality, wholesale distribution, faith-based organizations, and general business. Sage Intacct provides accounting and finance teams with real-time dashboards for management reporting and automates revenue recognition, intercompany eliminations, billing, and other complex processes.

Why Did the Companies Make the Switch?

The companies interviewed by IDC identified a wide range of different factors that drove them to consider Sage Intacct’s cloud-based solution. Common reasons included:

- The limitations of their legacy on-premises solution, particularly because they were resource intensive, were not agile, and lacked the functionalities needed to manage complex tasks

- The ability to integrate expense reporting management

- The need for better visibility of the organization’s financial health

- The desire to take advantage of a feature-rich cloud-based solution

The businesses surveyed viewed adopting Sage Intacct as a cost-effective way to modernize and improve business-critical accounting and finance operations by taking advantage of the benefits of cloud technologies.

Study participants elaborated on the factors that drove them to consider Sage Intacct:

“We have locations all around the country, so it’s very important that everything can be sliced and then put together very quickly. Our old system either didn’t do that or wasn’t configured to do that, and we needed to move to a solution that was a little more robust,”

“Our previous solution didn’t provide a lot of useful reports. Creating reports was a little bit of a task because we had to download different reports into an Excel spreadsheet and combine them into whatever information we needed. It was a lot of manual work.”

“We migrated from an on-premises solution to Sage Intacct…We wanted a cloud-based solution because we have four offices, and we needed the ability to access the data from anywhere on a real-time basis.”

What Operational Benefits Did They Gain?

Adopting Sage Intacct enabled the surveyed businesses to overcome the limitations of their previous legacy accounting and finance systems. It helped their accounting and finance teams to meet business needs by providing:

- Seamless connectivity, with reliable remote access that addressed pandemic-era necessities and continues to support remote users

- Improved platform functionalities that have streamlined operations

- Automated processes that reduced manual work

- Lower operational risks by minimizing errors

- The ability to run robust reports easily

- Multicurrency functionality

- Improved understanding of cash flow

- Improved traceability for improved financial transparency and audit trails

- Improved visibility, enabling fuller and more accurate financial forecasting and results

- Lower overall costs of finance and accounting operations by improving the efficiency of teams

Sage Intacct’s robust performance, agility, and functionality continue to empower the accounting and finance teams of these companies to overcome the daily challenges of maintaining and strengthening their businesses.

Key Findings

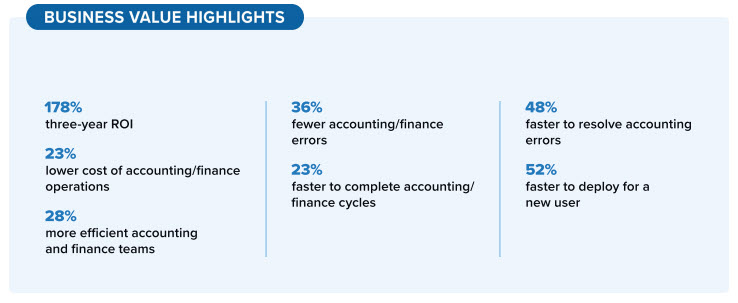

The IDC Study’s findings included these quantitative results for the businesses interviewed:

- 178% 3-year ROI

- 23% lower costs of accounting/business operations

- 28% more efficient accounting and finance teams

- 36% fewer accounting/finance errors

- 48% faster to resolve accounting errors

- 23% faster to complete accounting/finance cycles

- 52% faster to deploy for a new user

These verified metrics help illustrate the real-life business value of Sage Intacct and its impact on accounting and finance operations.

Get the Full Report

As you can see, small and medium-sized businesses are taking advantage of the many benefits of Sage Intacct. To find out more on how Sage Intacct can help your organization optimize its accounting and finance operations, download IDC’s full research study today.

Next Step.

If you’re currently using a small or medium-sized accounting and financial management solution like Sage 50, Sage BusinessWorks, QuickBooks or other solution, we’d like to show you how Sage Intacct can benefit your business. Contact us for a free software needs assessment.

This analysis will take a very detailed, comprehensive look at your company and all aspects of your accounting operations. The questions will help determine exactly where your needs lie and how well your current accounting system is meeting those needs. This analysis will identify features that are absolutely vital to your business so that you can be sure the new software system you select will fulfill your most important needs.

Register for our Sage Intacct newsletter today!