Have you entered the wrong account coding, effective date, or amount on an AP invoice? If so, then you are probably familiar with the process of reversing and correcting a posted entry in MIP.

Initially, it seems like a complex process to correct a posted entry.

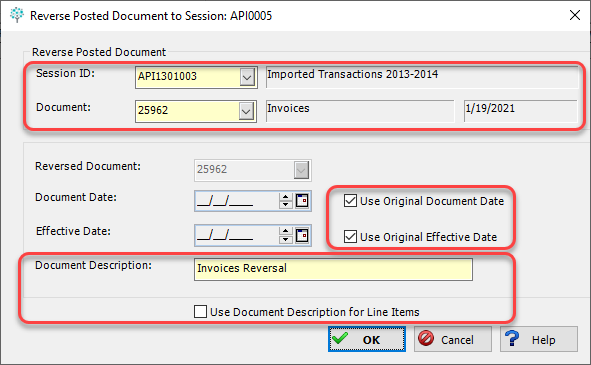

First, we must reverse the original document that was posted incorrectly. This must be completed by starting a session under ‘Enter Invoices’ in the Accounts Payable module.

![]()

Next, enter the Session ID that contains the invoice that needs to be reversed as well as the original invoice number.

Use Original Document and Original Effective Dates if you want the original document and the reversal document to offset each other as of the same date.

An instance where you may want those dates to be different is if the original accounting period is closed. Another example would be an accrual entry that needs to be reversed with an effective date in a future accounting period.

Document and Transaction descriptions can also be updated to incorporate that the entry is related to a reversing entry.

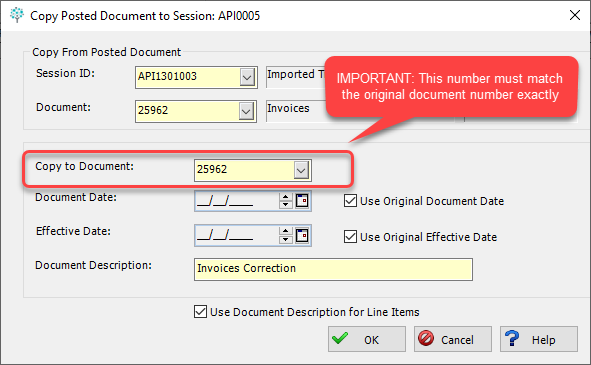

Then, you will need to start another new session to copy the original document and make any necessary corrections.

![]()

Similar to the reversing entry, you will be prompted to enter the Session ID and Document number that you need to copy. You will need to enter the Original Session ID and Original Document number.

If the document numbers do not match, the original entry will not be appended to reflect any corrections that are made.

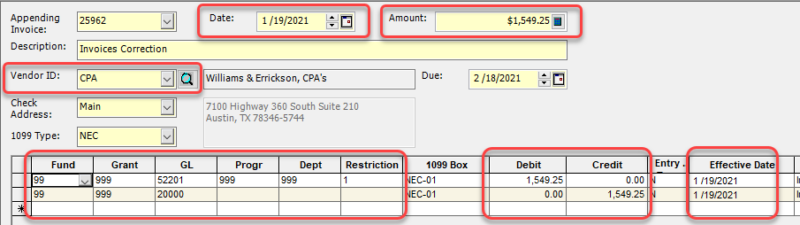

At this point, you will update any incorrect information, save, and post the sessions.

If you need assistance with making corrections or have any other issues with your MIP software, please contact our MIP support team at 800.232.8913.

Register for our MIP Fund Accounting newsletter today!